Recycling Li-Ion batteries in-house: The business case

Overview

When considering the business case for in-house EV Lithium-Ion battery recycling, some key factors need to be considered as summarised in the below article.

Biyat Energy & Environment Ltd specialise in supporting EV battery manufacturers make the informed choice for their business operations ensuring the most cost-effective, ‘green’ options are transparent to key decision makers. Biyat regularly support clients by performing cost-benefit analysis for an array of technologies in the development of sustainability objectives and executive roadmaps.

Market trends relating to the expected leading EV battery chemistries in the following decades, plus virgin material vs recycled material costs play a vital role in guiding manufacturers where to direct their research and financial investment. Also, whilst pyro- hydro-metallurgical recycling methodologies are well established in Europe and the Far-East - they are not without their shortcomings. Direct recycling offers a promising compromise albeit still in its early stages. Manufacturers need to support development of the varying technologies by partnering with recyclers and academic research institutions in parallel to promote the required improvements in recycling technology. Key focus should be given to recycling processes able to recover both cathode and anode materials that can be reused directly for LiB manufacturing (such as the OnTo process described). The use of Life Cycle Analysis (LCA) models such as Argonne’s EverBatt simulation can also help decipher the cost-benefit analysis of the various options presented.

Likewise, battery designs should be critically evaluated for ease of disassembly, with the introduction of semi-, fully-automated strip down systems implemented within manufacturing facilities - to further reduce the volume of module/pack level waste streams - following the motto #Battery Re-pair, #Re-manufacturing, #Re-purposing, #Re-Cycling.

Finally, partnering with the right logistics company who can collect End-of-Life batteries plus production scrap is a key step that requires a holistic overview of manufacturing facility, dealership, material recovery locations and volumes to faciliate closed-loop waste management requirements.

Recyclability & Market Trends - NMC vs LFP

Lithium Nickel Manganese Cobalt Oxide (NMC) batteries are constructed of a variety of materials including a cathode mix of nickel, manganese, and cobalt. Where many battery manufacturers plan to convert their battery chemistry to a larger percentage of nickel to utilize less cobalt, the price of these batteries are expected to drop even more in the future.

Lithium-Ion Phosphate (LFP) batteries use phosphate as active material in the cathode. LFP is undergoing a resurgence thanks to its safety, low cost, and impressive cycle life. The main advantage of LFP lies not in what it has, but what it lacks: nickel and cobalt. For recyclers, however, the lack of nickel and cobalt pulls the rug out from under their business: How are they supposed to make money from recovering dirt-cheap iron?

“As the cobalt content of battery chemistries reduces over time, and materials like LFP gain in popularity, the value that can be recovered from materials drops. This makes the economics of recycling more challenging."

What is expected for the future are two main technologies; low cost LFP and high performance (high nickel) NMC. Analysts BNEF, Roskill and others do not fully agree on the market share of the two technologies. The predicted percentages of LFP batteries in EVs of the future range from 15% to 40% by 2030.

It is unclear at this time where the needle of cost versus performance will end up and how this will translate into EV battery technology. But for the foreseeable future, it looks like only a quarter of new electric vehicle models built in China will be LFP, compared to 76% for NMC/NCA.

Also, the global electric vehicle battery market is projected to move away from using LFP, NCA, and NCM 111 cathodes in the following two decades. By 2040, NCM 9.5. batteries are expected to dominate the global electric vehicle battery market, with a market share of about 40 percent. The NCM 90 (NCM 9.5.5) cathodes further reduce the need of cobalt, which is scarse and expensive. Until we have completely cobalt-free batteries, NCM 90 cathodes are a required step forward to allow the massification of electric cars.

Supply Risks

The two most widely discussed strategies for addressing supply risks are battery technology development and progress in recycling. However, the extent to which they will relieve global and regional cobalt demand–supply imbalance remains poorly understood.

Cobalt is considered the highest material supply chain risk for electric vehicles (EVs) in the short and medium term. EV batteries can have up to 20 kg of Co in each 100 kilowatt-hour (kWh) pack (i.e., up to 20% of the weight of the cathode in lithium-ion EV batteries.) Cobalt is mined as a secondary material from mixed nickel (Ni) and copper ores. This means the supply is not independent of other commodity businesses and introducing new recovery projects is expensive.

Cobalt-free batteries and recycling progress can indeed significantly alleviate long-term cobalt supply risks. However, the cobalt supply shortage appears inevitable in the short- to medium-term (during 2028-2033), even under the most technologically optimistic scenario.

Recycling Methodologies

In hydrometallurgy, the electrodes from batteries are dissolved in acid. Individual metals can then be precipitated out by adjusting the pH of the solution.

In pyrometallurgy, the battery is simply burned in a high-temperature oven, recovering only a small fraction of metals in the cathode. Pyrometallurgical methods require simpler pretreatment methods (most often shredding or crushing) to prepare batteries for recycling and require fewer different methods to recycle LIB of differing compositions, shapes, and sizes. Lithium is recyclable by some pyrometallurgical methods, but the methods are most effective for particularly valuable metals such as cobalt.

In many cases, combinations of hydrometallurgical and pyrometallurgical methods are used to process lithium-ion batteries today. Pyrometallurgical methods are likely used because they allow flexibility in battery feedstock and make use of fixed investment in existing facilities. Methods in development, on the other hand, rely on hydrometallurgy to a larger degree, at least in part because the cost of facilities to implement the methods is smaller. Lithorec and Aalto University (Finland) both have devised hydrometallurgical methods, while Accurec, Battery Resources, and OnTo use both hydrometallurgical and pyrometallurgical methods.

For the majority of recyclers, both techniques require the destruction of an entire pack, mixing every polymer, electrolyte, electrode material, and current collector together. At that point, retrieving any metal, let alone the cheaper plastics and additives, is a daunting task. So, recyclers focus on the pot of gold at the end of the rainbow (or needle in the haystack, pick your metaphor): cobalt and nickel. Copper and aluminum can also be targets.

Consequently, the discussion is based on the ability of each technology to recover every component in LIBs. Indeed, only processes employing a combination of mechanical processing, and hydro- and pyrometallurgical steps seem to be able to obtain materials suitable for LIB (re)manufacture. On the other hand, processes relying on pyrometallurgical steps are robust, but only capable of recovering metallic components.

Direct recycling, aims to be a greener process that does not require intensive energy or chemicals, avoids the destruction of spent battery materials, and directly rejuvenates degraded electrode materials. This new recycling process can output well-defined cathode materials with high value that can be directly used to fabricate new lithium batteries. Also, the regenerated active materials from direct recycling might be more valuable compared to elemental products from pyrometallurgical and hydrometallurgical recycling methods.

The cathode active powder is the main target of most of emerging recycling processes because of its high economic value, particularly in formulations containing Co. The recovery of cathodes is, however, a complicated process, as it requires a vast number of preparation and enrichment stages before undergoing final hydrometallurgical refining. Proper purification of the EoL cathode material is crucial because of its high chemical sensibility, where minor contaminants may compromise the quality of the final product.

However, it is important to note that direct recycling of lithium batteries is still a relatively new technology, and there are several challenges that need to be overcome to make it economically and technically feasible on a large scale. Some of these challenges include developing efficient and cost-effective methods for disassembling and sorting batteries and optimizing the recovery of valuable materials such as lithium, cobalt, and nickel.

Furthermore, direct recycling can be costly, making it difficult to compete with mining new resources. Recyclers require specialized equipment and skilled labor, which can be expensive. Safety is also a concern with direct recycling. Lithium batteries contain flammable electrolytes and can be a fire hazard if not handled correctly. That’s why, recycling facilities must take appropriate safety measures to minimize these risks.

Following on from the above, a key consideration is the cost of the raw material required for the cathode vs cathodes processed via direct recycling techniques. For example, for LFP chemistries, the cost of direct recycling is higher than the raw material. Also, future challenges are envisaged with converting older end of life cathode chemistries to the most modern, high-performing ones required.

As seen in Table 2, only two of the state-of-the-art recycling processes are specialized for treating LIB, i.e., Sumitomo–Sony and Akkuser. Of the emerging processes, only the OnTo Process is capable of treating primary and secondary LIBs simultaneously. The rest of the processes are specialized for one or the other. Nevertheless, while Umicore and Recupyl processes were not initially designed for the processing of LIB, the increasing presence of these types of battery in waste streams pushed for a redesign to accept LIBs as part of their feed. At the same time, the Umicore and Sumitomo–Sony processes claim that their products can be mixed with virgin materials and used as raw materials for batteries. In this manner, the requirement for pristine material is reduced without sacrificing quality requirements.

The OnTo process is of particular interest, as it recovers cathode and anode material from spent LIBs to a point where they can be reused directly for LIB manufacturing in contrast to other emerging technologies. Similar processes, like Battery Resources, LithoRec, and Accurec, obtain similar products in line with the Circular Economy (CE) concept. However, their processes still have flaws, i.e., losses in the form of non-recovered anode material. In addition, the Aalto University process presents a recovery of the vast majority of the LIB compounds; however, the recovered forms still require further processing to be considered usable raw materials.

There has been a general shift regarding the final aim for materials recovery in current and emerging technologies. While the former focuses on metals recovery (or alloys), the latter also aims to recover cathode or cathode precursor material. In addition, the goal of diminishing material losses is more explicitly pursued by the emerging processes.

On-site Disassembly

Several initiatives can be employed on site to reduce the volume of module/pack level waste streams. These generally fall into four categories:-

Battery Re-pair (Control electronics failure)

Battery Re-manufacturing (Cell failure)

Battery Re-purposing (Pack state of health failure)

Battery Re-Cycling (Battery cells no longer hold state of charge)

Provision of facilities to accommodate the above stages can significantly maximise reuse of otherwise discarded assets that still contain value.

The disassembly of lithium-ion battery systems from automotive applications is a complex and therefore time and cost consuming process due to a wide variety of battery designs, flexible components like cables, and potential dangers caused by high voltage and the chemicals contained in the battery cells.

Typically, disassembly from the system level down to the module/stack level is considered. Looking at an industrial level of disassembling, it is neither economically feasible nor required from an environmental perspective to dismantle each and every part. Also, joint parts made from the same materials need not be separated as they are supplied to the same material recycling process.

Several aspects relating to battery design have potential to increase the complexity of disassembly. One difficulty arises from the many different screw types that are used for the joints. This contributes to time lost during disassembly due to tool changes. Furthermore, not all screws are accessible from the same direction. The screw joints are typically at the top, at the side covers and at the bottom of the battery system. This will require several orientation changes of the tool and even a turn-over of the whole battery or at least bottom accessibility.

Further challenges, especially when considering an automated approach, are flexible components such as cables and joints that are difficult to access such as the plug-in connectors of the BMS. All these mentioned design aspects lead to the conclusion that a full automation of the disassembly process would be very complex to realise and thus very expensive for lower volumes. Another alternative is partial automation of the disassembly process using a KUKA Light Weight Robot or equivalent as demonstrated by Audi.

The main safety risks during disassembly are liked to be caused by the high voltage and the chemicals in the battery cells (mainly the electrolyte). Therefore, adequate means should be taken to discharge prior to disassembly plus appropriate protective measures for the worker and the environment are required like electrically isolated tools, hand gloves, shoes and floor cover. Bosch have recently patented an automated discharging solution allowing for battery modules to be chemically deactivated, offering a much quicker method than current manual processes that can take up to 24 hours for deep-discharge.

A further safety risk arises from the electrolyte in the battery cells. In case of the damaging of a cell during the disassembly process the electrolyte may cause fire or toxic gases. In order to protect the worker, disassembly work stations should be equipped with appropriate fire extinguishers (dry chemical or carbon dioxide), emergency kits, gas masks and an extraction unit.

A typical disassembly work station is depicted in below. The batteries are transported from the stock to the work station by means of a conveyor. At the work station the battery system is placed on a table where either two workers or one worker and a robot (the KUKA LWR) disassemble the battery. For the human worker(s) the required (electrically isolated) tools are clearly arranged on a board and well accessible. On this board or next to it the fire extinguisher, emergency kit etc. should be placed. For the robot, a tool changing system is provided. The disassembled parts have to be separated into four categories: electronics, metals with iron, battery modules and residual materials. The battery modules are further transported to the next station which is either a further disassembly station or coarse shredding. In the whole work station all areas have to be well accessible within a short distance.

Regulatory & Permitting Issues

For those manufacturers seeking to develop hydrometallurgy, pyrometallurgy or direct recycling processes in-house. A due consideration is the regulatory and permitting obstacles that arise from such activities - lessons can be taken from other recycling entities who have failed to receive the appropriate permissions from the UK Environment Agency.

The Agency lists issues relating to the Fire Prevention Plan, out-of-date Technically Competent Management details, and how waste including black mass and hazardous electrolyte would be handled and stored, among other things such a poor track record of environmental compliance.

Life Cycle Analysis (LCA modelling)

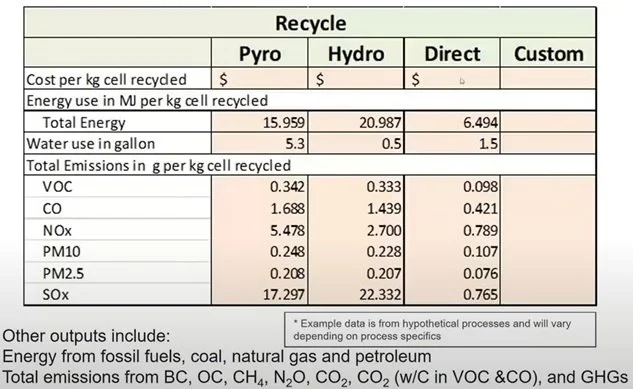

Argonne’s new EverBatt LCA model has significant potential to assist manufacturers determine the most appropriate recycling pathway for their End-of-Life (EoL) batteries by conducting a techno-economic analysis which can be extended to future battery chemistries or different products.

When using the model, manufacturers need to consider the potential sources of waste material, i.e. EoL and production scrap - and the relative volumes expected both short & long-term. Also, they should calculate their current battery portfolio life expectancy to understand what volumes are due to reach their end of life and when.

Manufacturers would also do well to set realistic recycling targets. For example, Northvolt are now aiming to recycle 125,000 tons a year, which would amount to approximately 30 GWh of annual battery production, up from the previous 25 GWh. The long-term plan of producing cells with 50% recycled material by 2030 across all operations remains. Beyond 2040, it is predicted that most raw materials used in Northvolt's batteries would come from recycling.

Logistics

Following on from previous articles relating to waste battery transportation and onsite recycling facilities; manufacturers would do well to partner with a competent logistics firm experienced with LiB waste streams. One such company is ECOBAT Logistics who offer a timely and cost-effective collection service for battery quantities ranging from 5 kg to 28 tonnes. Its headquarters in Darlaston, West Midlands, has a dedicated battery sorting operation to identify all battery chemistries and separate for optimum recycling. Finally, they have a comprehensive recycling network and co-operate with UK/EU based sister companies for onward recycling.

Availability of Recycling Partners

A key obstacle for manufacturers is the availability of local recycling partners with industrial sized, established operations. It is critical to follow the latest developments and global leaders in this field, in addition to formalising the relevant partnerships, particularly with academic institutions developing novel processes for custom chemistries.

PLANS for Teesside to host the UK’s largest EV battery recycling plant are underway following the completion of a six-month feasibility study by the facility’s owners, Altilium Metals, which will allow the company to accelerate permitting and grant requests as well as alternative financing.

The study has been carried out in collaboration with international consultancy Hatch – the plant’s designers – and completed under a grant from the UK government’s automotive transformation fund. The business case for the plant is built on technology that has already been proven at the laboratory scale under a research program in partnership with the University of Plymouth.

The firm says its processing technology recovers more than 95% of the critical metals and 80% of the battery value; and results in a 35% cost-saving and 38% reduction in emissions compared to the mining of virgin material.

According to the report, the plant will comprise two processing facilities: a chemical plant producing 95,000 t/y of battery precursors, including nickel sulphate and lithium carbonate, and a plant producing 30,000 t/y of cathode active material (CAM) recovered from end-of-life EV batteries and waste from gigafactories.

To alleviate possible shortages in battery waste supplies for mega-scale recycling, the plant will incorporate an option to process raw materials, such as primary nickel-cobalt mixed hydroxide precipitate (MHP), that is mined in Indonesia where Altilium Metals holds interests, as well as from offtake agreements with local companies. MHP is a nickel intermediate product which is used as a primary feedstock in the production of nickel sulphate, a crucial ingredient in the lithium-ion battery supply chain. The ability to include MHP as a feedstock will be critical to the success of the Teesside plant, Altilium Metals said.

A spokesperson at Altilium Metals, said: “Any ‘pure’ battery recycler relying on spent battery and gigafactory scrap in the short term will struggle, given the limited number of end-of-life batteries currently in the market.” The spokesperson added that shortfalls meant a rival materials firm was having to use 70% primary raw materials in their recycling plant.

The feasibility study is one of a number of milestones Altilium Metals has achieved in the last year. The firm has begun recycling EV battery black mass at the tonne scale at its analytical laboratory in Devon, after receiving a permit from the UK Environment Agency in November 2022. It says this makes it the only company in the UK that is currently recovering critical minerals from end-of-life EV battery waste.

Altilium Metals’ next stage in the scale up of its proprietary recycling process is a pilot plant designed to recycle black mass battery waste from one electric vehicle per day. This will allow characterisation of a mixed stream of feed chemistries, production of samples for qualification by original equipment manufacturers (OEMs), and experimentation to streamline the process, the firm said. Data gained from the pilot will help the firm make informed decisions on mixed feedstocks, scalability and product quality for industrial scale recycling at the planned Teesside plant, which is expected to create around 250 high skilled jobs and thousands more in the construction phase.

We hope you found this article useful!

If you require assistance developing an approach to battery recycling in your business or manufacturing facility…we are here to support you every step of the way.

Contact — Biyat Energy & Environment Ltd (biyatenergyenvironment.com)

This article was written by Luay Zayed, founder of Biyat Energy & Environmental Ltd. A global energy and environmental consultancy specializing in turnkey engineering solutions that protect the environment and improve energy efficiency in the manufacturing & industrial sectors.